Avoid The Student Loan Debt Trap

“Education is the ticket to success.”

– Jaime Escalante, former L.A. high school teacher

We’ve all heard a variation of that saying, but where can that ticket take you, and how much will it cost?

The average salary in the U.S. for an individual with a high school diploma is roughly $35K per year. However, Amelia Josephson at Smart Asset suggests that individuals with an associate degree earn $41K annually, while those with bachelor’s and master’s degrees respectively earn $59K and $70K a year on average.

As mentioned in “The College Payoff: Education, Occupations, Lifetime Earnings, Center on Education and Workforce,” bachelor’s degree recipients typically earn nearly $1 million more over their lifetime than those without a college degree.

North Carolina has set “degree attainment” goals to increase the number of residents who hold a college credential or degree. According to The Education Trust, states need to “increase the shares of Black and Latino adults in those states that have college credentials and degrees … as population growth among communities of color continue to grow.” Although White attainment outnumbers Black attainment, North Carolina is ranked above average in the degree attainment gap.

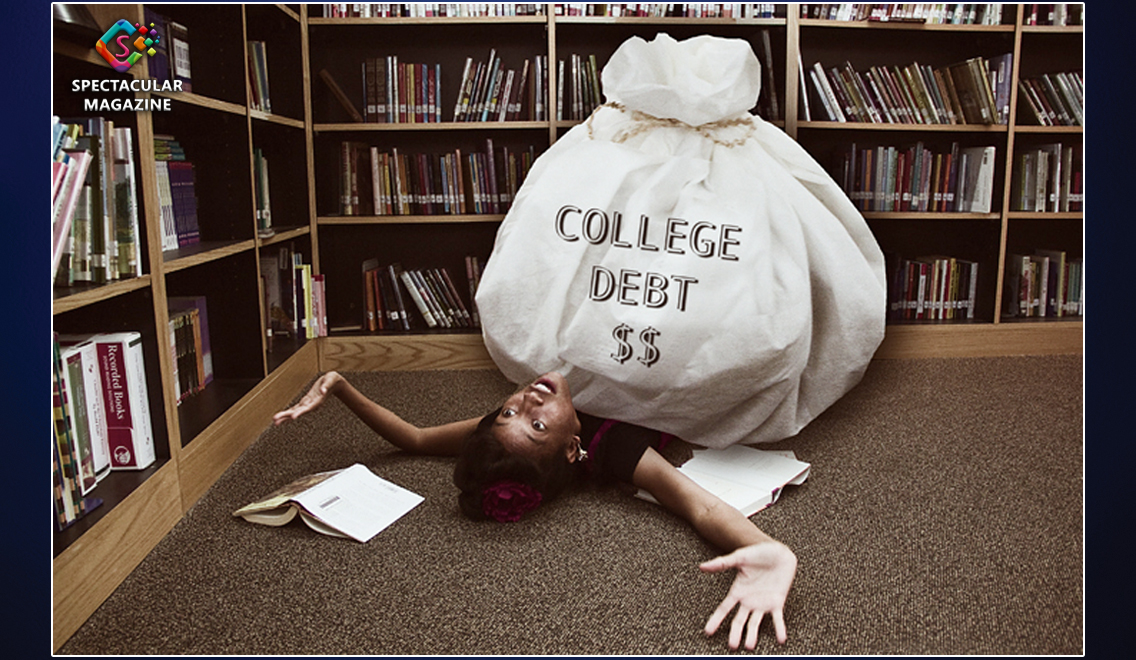

Student Loan Debt

Unfortunately, a major barrier for many to obtain a high-quality education is money. The average cost of attendance per year (including tuition, housing, books, etc.) is $26,590 at public colleges and $53,980 at private colleges. Two-thirds of the country’s outstanding student debt is carried by women. And while the average White student loan borrower owes around $30,000, the average Black borrower owes closer to $34,000.

According to a study from the Center for American Progress, African Americans who entered college in 2011 and took out federal student loans defaulted on those loans at sharply higher rates than did their peers of other races (32% default rate vs. 18% for all borrowers).

Compounding the problem is predatory practices by private for-profit colleges. Last year the Durham-based Center for Responsible Lending released a report on North Carolina’s student debt that states that for-profit colleges “disproportionately target low-income residents, African Americans, women, servicemembers, and veterans.” In fact, the University of Phoenix recently had to pay $191 million to settle claims of deceptive advertising.

Solutions

Although it’s unlikely that the cost of college will come down soon, there are several options to help students graduate with as little debt as possible.

- Community Colleges – North Carolina has the third-largest community college system in the country, spanning 58 campuses. The average annual tuition is $3,911, and in many cases, the credits can transfer to four-year schools.

- Responsible Borrowing Initiatives – Some schools have implemented programs to help students understand the full lifecycle costs of earning a degree. This includes a proactive approach to explaining loans and encouraging students to borrow only what they need rather than what is offered.

- Grants and Scholarships – You might qualify for federal Pell Grants or various scholarships. Radio host Clark Howard’s website lists “12 Best Ways to Find College Scholarships.” The College Foundation of North Carolina also provides resources, but it starts with filling out the Free Application for Federal Student Aid (FAFSA) form. It’s a hassle but it’s often worth it.

- Tuition Assistance – Ask your employer if they offer a tuition assistance program. Carla Wilkins of Raleigh was able to combine a scholarship and tuition assistance to completely finance her studies toward a bachelor’s degree in cybersecurity.

- Nonprofit Online Universities – Without campuses, athletics or lifestyle amenities, nonprofit online universities can charge much lower tuition. Competency-based universities like WGU North Carolina let students accelerate at their own pace, so determined students often earn their degrees quicker, saving even more money. Be sure to check that the school is accredited.

That ticket to success can take you to a better future. And with the right research and resources, you can get that ticket without taking on crushing student loan debt. Believe and achieve!

Submitted By Tenita Philyaw-Rogers, Strategic Partnerships Manager, WGU North Carolina